We log anonymous usage statistics. Please read the privacy information for details.

Current Issue

Full Issue

Editorial

Research Notes

Review Articles

Current Debates

Interventions

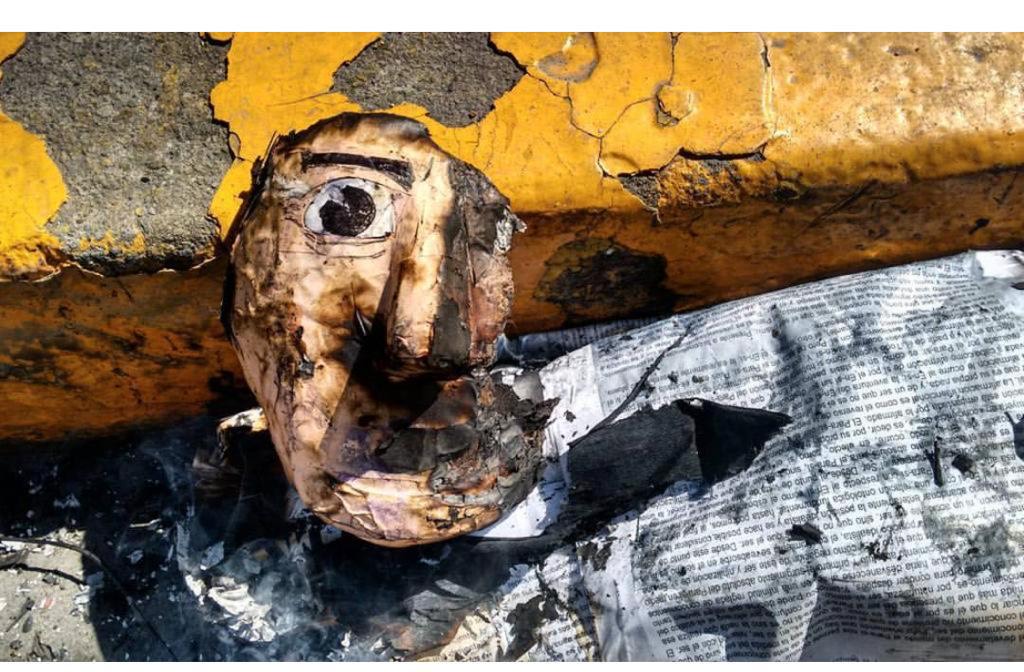

Ya no fueron más Tlahtoani (el gobernante mexica) y Temachtiani (maestro). Corría 1533, y esos mexicanismos fueron articulados en el Real Colegio de Santa Cruz de Tlatelolco en México, quizá por primera vez, para nombrar otra realidad: la del virrey y el sacerdote. Luego, esta configuración colonial selló, con significativas variaciones locales, un modo particular en el que se han ejercido las relaciones entre poder político y cultura en América Latina. Cuestionarla no es, entonces, una curiosidad de anticuario. Tampoco se trata de un atavismo cultural propio de la periferia. Ni mucho menos de un inocuo divertimento intelectual. El presente número de Crolar revisita esta relación en la época del neoliberalismo global y sus derivas autoritarias y progresistas a nivel regional.

En América Latina existe una tradición larga y significativa de reflexiones y análisis acerca del poder y la política. Sin embargo, en los últimos años y debido a sesgos disciplinares o ideológicos, estos estudios han privilegiado aproximaciones que circunscriben la realidad de lo político a los procesos e instituciones democráticas de alcance estatal, en un gesto que termina separando la política de sus contextos sociales y económicos, y ocultando también sus vínculos con el campo de la cultura. No obstante, intelectuales, notables, mandarines, expertos y tecnócratas han nutrido y masculinizado históricamente estos vínculos, contribuyendo así a su naturalización.

Por el otro lado, y aun cuando se trata de sujetas y sujetos sensibles al ejercicio del poder, las y los productores culturales ... more

Luis Emilio Martínez Rodríguez, Felipe Lagos Rojas & the CROLAR Editorial Team